🔥 This offer expires in:

🔥 This offer expires in:

+1 614-859-5783

+1 614-859-5783

For anyone stuck with unpaid debts and being hounded by collectors, unsure where to turn next…

Wipe out 90% of your debt. Stop harassing calls, rebuild your credit, and FINALLY sleep peacefully at night...

WITHOUT Expensive Lawyers, Endless Negotiations, or Bankruptcy Filings.

All Unsecured Debt Types Covered – Credit Card Debt, Medical Bills, Personal Loans, and Student Loans

4.8 / 5 based on 1,931 reviews

JOE NORRIS

TEACHER & DAD OF 3

I Before finding this guide, I felt completely hopeless. Debt collectors were calling every day, and I couldn’t see a way out. But within 30 days of using Joel’s strategies, I removed my debt down by 70% and finally got them off my back. Thank you so much!”

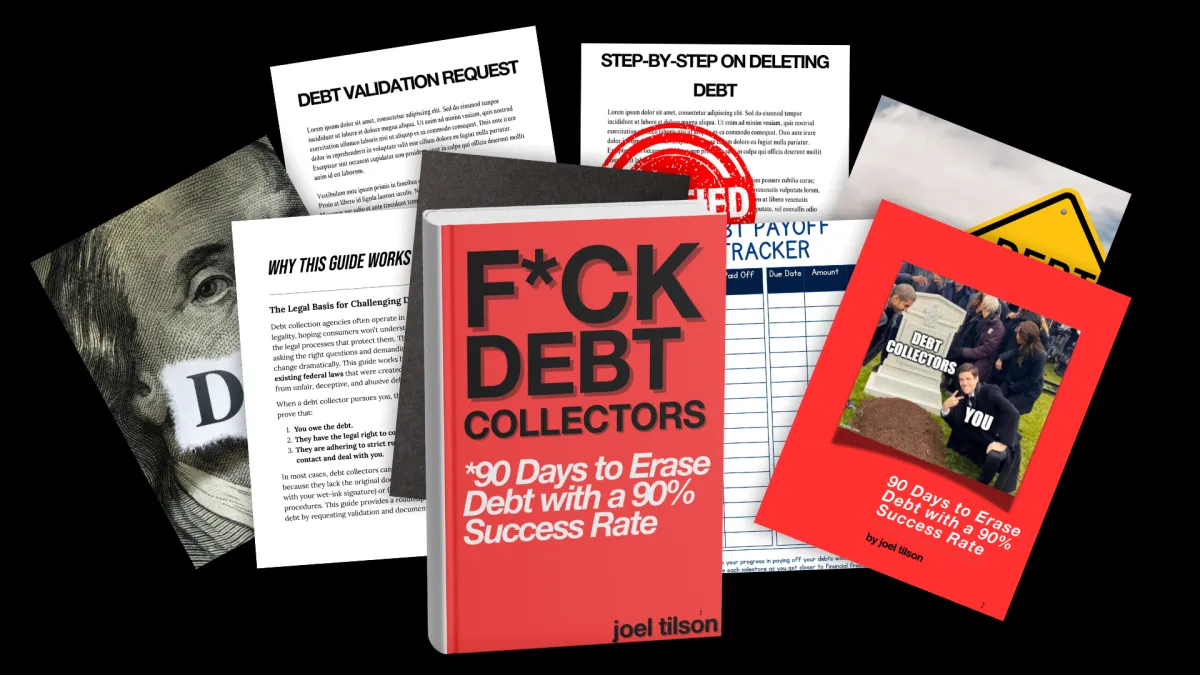

INTRODUCING THE DEBT COLLECTORS WORST NIGHTMARE

79% of consumers with unpaid debt face aggressive collection tactics - here’s how to flip the script and erase your debt for good.

Tired of the relentless calls, letters, and threats? Learn how to legally slash your debt by up to 90%, stop harassment for good, and finally sleep peacefully—without shelling out thousands to shady debt settlement firms or filing for bankruptcy.

Every year, millions of people stuck in debt make payments without realizing they’re falling further behind. You hand over your hard-earned money to creditors, but with compounding interest and hidden fees, the balance barely shrinks—while debt collectors and banks rake in huge profits.

Over time, this relentless cycle drains your finances and your peace of mind—leaving you feeling stuck and powerless. This guide reveals a way out. Instead of endlessly paying down debts and enduring harassment, learn strategies that legally reduce or erase what you owe, rebuild your credit, and put you back in control of your financial future. It’s time to stop being a passive victim and start fighting back, using proven methods that require no expensive legal help—just the knowledge inside this guide.

F*CK Debt Collectors isn’t about ignoring your debt, giving in to unethical collection practices, or filing for bankruptcy as a last resort. Instead, it’s about fighting back and erasing debt strategically. This 180-page guide is packed with proven strategies that help you enjoy: Immediate relief: End harassing calls and letters from collectors.

Stop Debt Collectors in Their Tracks

Learn the exact legal strategies to shut down harassing phone calls, letters, and threats from debt collectors for good. With proven scripts and tactics, you’ll take back control and put an end to the harassment.

Slash Debt Legally by Up to 90%

Discover how to legally reduce or erase up to 90% of your debt using little-known loopholes that debt collectors don’t want you to know about.

Rebuild Your Credit the Smart Way

Clearing debt is only half the battle. This guide also shows you how to boost your credit score fast, so you can get approved for better rates and opportunities in the future.

Financial Freedom in Less Than 5 Minutes a Week

With easy-to-follow steps, you’ll learn how to manage your finances in under 5 minutes a week. No confusing jargon—just actionable tips that get results fast.

MORE THAN JUST A PDF

Knowledge is power. Introducing your superpower...

Right after your purchase, you'll receive all the links to download our guide in just a few clicks!

Understanding the Debt Game...

What’s Inside:

A breakdown of how debt collection works and the tactics used by collectors to intimidate you.

Your legal rights under the Fair Debt Collection Practices Act (FDCPA) to protect yourself from harassment.

A quick debt assessment checklist to help you prioritize which debts to tackle first.

The Debt Defense Blueprint...

Step-by-step scripts to fight ba with debt collectors like a pro.

The optimal timeline for offering settlements to ensure maximum success.

Techniques to stay calm and confident during stressful negotiations.

Rebuilding Your Credit

How to dispute errors on your credit report and improve your credit score quickly.

A 3-step credit boost strategy to increase your score by 100+ points in a few months.

The safe use of credit cards to prevent future debt traps.

Budgeting for a Debt-Free Life

A debt-free budgeting method to manage your finances without feeling restricted.

The emergency fund formula to build a safety net and avoid future debt.

Simple savings hacks to increase your monthly savings without major lifestyle changes.

Bonus Resources...

Here's the course content:

Debt negotiation scripts

Credit dispute letter templates

Debt prioritization checklists

Budgeting worksheets

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

Verified Review

SARAH LEWIS

“This guide is a game-changer! I was skeptical at first because I tried other methods, but nothing worked. Joel’s tactics are straightforward and easy to follow. I’ve already cleared 50% of my debt, and I’m on track to be debt-free in the next month.”

Verified Review

DAVID CHEN

"I had multiple debts, and collectors wouldn’t stop harassing me. After following the scripts in this guide, the calls stopped, and I settled my largest debt for less than half the amount owed. I can’t thank Joel enough!”

4.8 / 5 based on 1,931 reviews

READY TO GET STARTED?

Get F*CK DEBT COLLECTORS PDF Today!

Stop praying for a solution tomorrow, and start fighting back today!

F*CK DEBT COLLECTORS

$47 USD

4.8 / 5 based on 1,931 reviews

Still Got Questions?

Here's The Answers

Will this guide work for any type of debt?

Yes! This guide is designed to help you manage and reduce most unsecured debts, including credit card balances, medical bills, personal loans, and more. However, it doesn’t apply to secured debts like mortgages or auto loans. You’ll learn specific strategies tailored to the unique nature of unsecured debts.

How long will it take before I start seeing results?

Many people report significant progress within 30 to 90 days, depending on how quickly they implement the strategies. Some users have even managed to reduce or settle debts within weeks. The key is consistent action and following the steps outlined in the guide.

Do I need any prior financial knowledge to use this guide?

Not at all. This guide is written in simple, straightforward language that anyone can understand. You don’t need to be a financial expert—just a willingness to follow the steps and take action is all you need to get started.

4.8 / 5 based on 1,931 reviews

All rights reserved JTMorgan LLC.

Disclaimer:

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.